Stop taxing periods. Period

What products and consumables do you consider essential to maintain a decent standard of living? I’m guessing that exotic meats such as horse, ostrich, crocodile and kangaroo wouldn’t make it into your top ten (or even cross your mind). In...

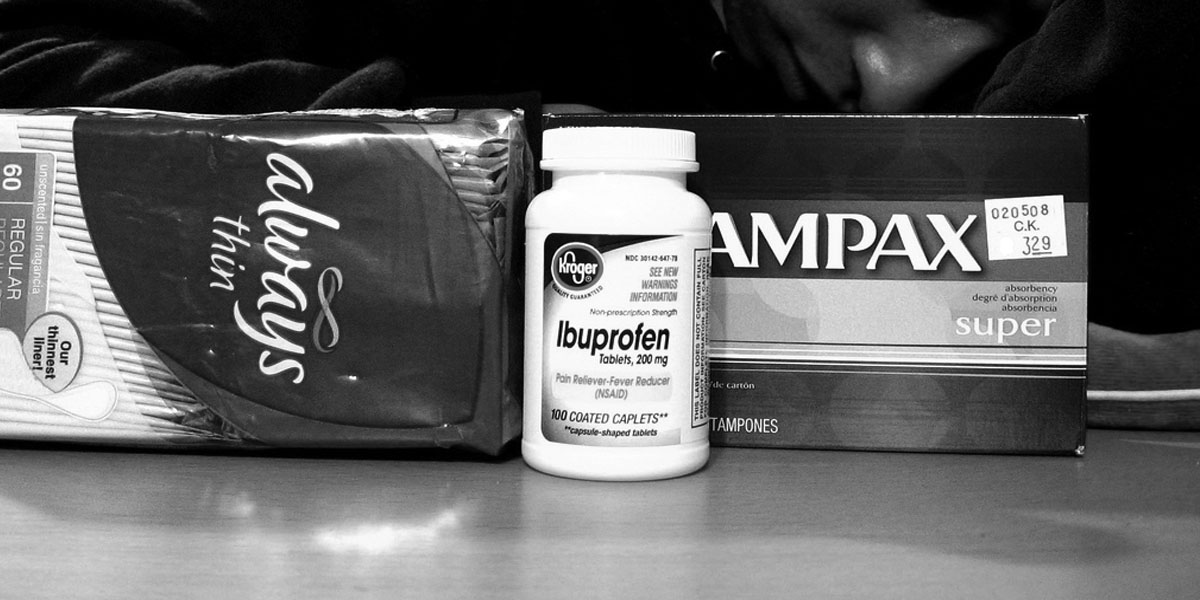

What products and consumables do you consider essential to maintain a decent standard of living? I’m guessing that exotic meats such as horse, ostrich, crocodile and kangaroo wouldn’t make it into your top ten (or even cross your mind). In that case, you could probably just about live without edible cake decorations such as jelly shapes, sugar flowers and chocolate scrolls. But these items are free from HM Revenue and Customs’ tax regulations, while women’s sanitary products are subject to a five per cent tax rate.

This is an obvious imbalance of tax priorities – men’s razors are not subject to tax but sanitary products are for their “non-essentiality” – and brings to light the fact that taxation policy is far from gender neutral. Products are being judged against their essentiality by politicians (of whom the majority are male), rather than according to the needs of society as a whole.

Without good sanitary care, women’s personal and professional engagements become impossible, along with any basic enjoyment of life. Their overall health can also be put in jeopardy: a problem encountered by many all over the world. Our campaign argues that British and European politicians should be encouraging the use of something as crucial as safe sanitary products, rather than effectively penalising through taxation those who menstruate.

We thought something needed to be done to challenge the parliamentary myth that those who experience menstruation should pay over the odds for sufficient sanitary products, so together with Rosie Scott, a friend of mine, I started a petition. Despite our expectation that it would struggle to reach 200 signatures, over 36,000 people of all ethnicities, genders and ages have passionately engaged with and actively supported our campaign “Stop taxing periods. Period”.

Before 2001 sanitary product VAT was charged at the full rate of 17.5 per cent because they were deemed to be “non-essential” at a time when women were less present within Westminster. However, there is hope for our campaign. In 2000, Paul Burstow, a Liberal Democratic MP who went on to become a minister, described sanitary items as far from “luxury products”. A year later the tax rate was reduced to five per cent. If politicians accept the necessity of sanitary products, then logically the tax rate should come down to zero. The decisions on VAT are made at European Union level, so we are lobbying Brussels, but we also want the British government and parliament to support a zero rate so we are contacting MPs as well.

Although small, the amount of money saved for individuals by abolishing the current five per cent tax on sanitary products will be significant for women and their families who struggle to pay for a basic standard of living. However, it won’t be significant enough to be missed by the Exchequer. The annual tax revenue gained from sanitary products can be estimated at £45 million. This is 0.0076 per cent of the government’s total tax revenue, and accounts for 76 pence in every £10,000 accumulated. This means that while it is not a significant figure as far as the budget is concerned, it could be an important amount of money if it were spent elsewhere.

Not only this, but abolishing the five per cent tax rate on sanitary products will be a timely example of women-centred policy making that recognises the importance of gender equality. It will also force the EU to accept the essentiality of safe and hygienic sanitary products for women.

Since its launch a few weeks ago, we have been amazed by the positive reaction the campaign have received from its London roots to as far away as Abu Dhabi and New York. We aim to challenge our society’s enduring discomfort about openly discussing periods and show that despite the fact that this issue is not immediately essential to the majority (75 per cent) of our politicians, it is still fundamental to a more equal society.