GDP figures: will the ‘good news’ keep coming?

Figures released today put UK GDP for quarter three growth at 1 per cent. Speculated over for weeks, the release of today's figures will not end discussion as to whether the UK economy is now on the road back to...

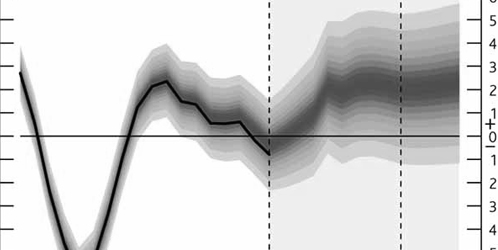

Figures released today put UK GDP for quarter three growth at 1 per cent. Speculated over for weeks, the release of today’s figures will not end discussion as to whether the UK economy is now on the road back to pre-crisis output following its longest recession since the second world war. David Cameron expressed his unsurprising position in this debate at PMQs yesterday, relishing a small scrap of good news that ‘will keep coming’. How accurate is this?

Today’s statistics are better than some forecasters had predicted, NIESR having estimated 0.8 per cent, more optimistic than Capital Economics’ 0.6 per cent. But as more than one commentator has noted in recent months, the UK economy is currently one of paradoxes and conflicting signals. Most puzzling among these has been UK productivity. At this stage in a deep recession such as that which the UK has experienced, one would expect to see a rebound in productivity as companies shed workers on the expectation that labour will remain weak. But instead we have weak productivity and better than anticipated (read ‘less bad’) unemployment, suggesting that companies are functioning with a large degree of spare capacity, leaving many economists scratching their heads.

If today’s figures do not display quite such a paradox, they at least can be contrasted with less encouraging features of the UK economy’s health. Although annualised today’s output reading for Q3 are not negligible, it may not be the turning point on the road back to growth that Cameron indicated yesterday. Nor will it do anything to silence opposition claims that inflexible decisions about the profile and pace of fiscal adjustment is the key factor holding back the UK’s recovery.

For one, there are a number of one-off factors positively impacting on today’s statistics which add context to the actual underlying output beneath the figures. Most significant is the impact of Olympic ticket sales, which the ONS estimate have boosted Q3 growth by about 0.2 per cent. Another contributing factor includes the bounce back after last year’s extra bank holiday weekend, with many estimating that the combination of the Jubilee and the Olympics has added 0.7 per cent to output. This therefore points to around 0.3 per cent underlying growth (the margin of error in the ONS’s preliminary estimates being +/– 0.7 percentage points).

More worryingly in the medium-term, however, is evidence that while output may have expanded, demand in the UK remains stubbornly depressed. Despite data by Markit indicating more a more marginal squeeze on household spending power, research by Which? and others have recorded continued pessimism about the future prospects of household balance sheets. As other commentators have remarked, given that it is household spending that currently exerts the main drag on growth, this is concerning.

In coming quarters we can expect more lacklustre growth than that posted today. Indeed it is already being reported that treasury sources are warning that growth may ‘retreat’ again and Labour sources are pointing out that GDP figures remain unchanged from a year ago.