The Paradise Papers and the case for wealth taxes

For me, the most interesting part of the Paradise Papers offshore leak was an offhand comment about a tax payment made seventy years ago. The leak revealed that the Grosvenor estate in central London, owned by the Duke of Westminster’s family...

For me, the most interesting part of the Paradise Papers offshore leak was an offhand comment about a tax payment made seventy years ago.

The leak revealed that the Grosvenor estate in central London, owned by the Duke of Westminster’s family trusts, had been using offshore companies.

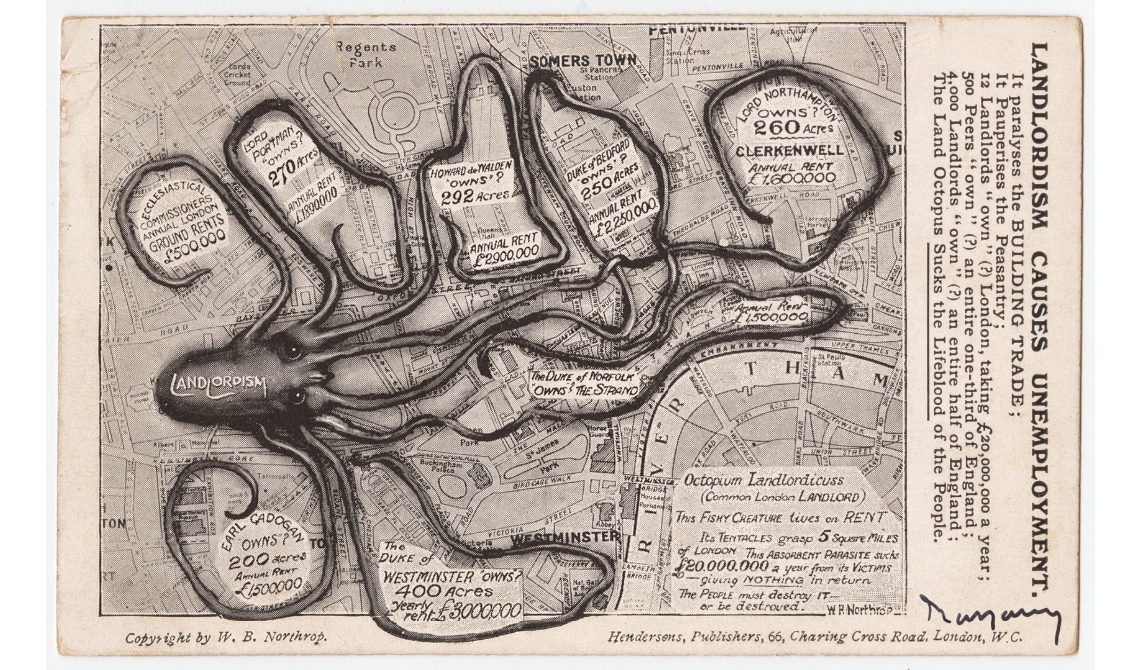

“Landlordism” by WB Northrup, 1920, showing the Duke of Westminster’s London landholdings.The seventh Duke, aged 27, is estimated to have inherited about £9.5 billion in 2016. He avoided 40 per cent inheritance tax through the use of trusts. In one sardonic line the Guardian summed up what is wrong with the way our tax system currently treats the very rich:

“The family’s enthusiasm for trusts may be explained by the fact that death duties of £17m swallowed much of the second duke’s £25m fortune.”

The third Duke’s wealth was also taxed effectively when he died in 1963: £11m was paid on wealth of between £40-60m. Yet by the time the fifth Duke died in 1979, his £650 million fortune led to a tax bill of only £5 million.

Clearly the system of tax treatment of vast wealth, which was working to create greater equality in the 1950s and 60s, is now broken.

This can be seen in a new estimate of the share of total financial wealth held by the uber-wealthy, those in the top 0.01 per cent, which show a significant rise from the 1980s. Not all of this is inherited of course: it consists of accumulated earned and unearned income and capital gains, and is driven by forces such as the growth of the financial sector and spiralling property prices, not just the tax system.

Source: Annette Alstadsæter, Niels Johannesen and Gabriel Zucman, Who Owns the Wealth in Tax Havens?For the first time this analysis also reveals an estimate – $498 billion – of the proportion of UK financial wealth held in offshore tax havens. This figure – which is only available for 2007 – is very much an estimate but may be conservative as it does not include physical wealth, such as property or jewellery.

We can put this $498bn figure alongside other data. According to Sunday Times Rich List in 2017 the top 1000 families own £658 billion. This is more than the total wealth of the bottom 40 per cent of UK households (who own £496bn), more than pension wealth of the bottom 60 per cent (£491bn), and exceeds the “bottom” 90 per cent of UK households’ (non-pension) financial wealth (£546bn).

We should start to consider wealth taxes seriously. In addition to reducing such vast inequality there is a need for tax revenue to help fund public services properly. For example, in 2013 the NHS estimated that it would need an extra £30 billion per year by 2021 to cope with ageing population.

There are a range of options. For example, in my Fabian report, A Unique Contribution, I designed a one-off wealth tax on worldwide assets in which a much more stringent approach is taken with those who have used tax havens in the past. But there are other approaches. For example, trusts are subject to a form of wealth tax, a periodic charge of 6 per cent paid every ten years. This could be reformed.

We could also reconsider wealth transfers in the context of the current favourable treatment of unearned income compared with earned. (Take two examples: national insurance contributions are a type of income tax and yet are not paid on unearned income. Dividend tax allowances on top of people’s personal tax allowances also tilt the balance in favour of unearned income.) Some form of lifetime accessions tax could be considered, or a closer alignment of inheritance and income tax. It is difficult to explain to a hard working entrepreneur why their income should be effectively taxed at a higher rate than the gifts received by their feckless neighbour.

None of these proposals are politically easy and so we might also consider recycling some of the revenues back into reducing taxes on earned income for low and middle income families. The Labour party is, after all, the party of work. It might be a politically fruitful faultline to exploit in a Tory party which rhetorically promotes reward for work, but actually acts to protect inherited and unearned wealth.